23+ reverse mortgage terms

Web A fee charged by the lender to cover its expenses for originating the loan. Web Tap into your home equity to fund your retirement.

Dean Jones Reverse Mortgages Request Information 1040 F St San Diego Ca Yelp

Earnest money is a deposit offered by a buyer as a token of good faith when an.

. HECM origination fees are capped at 6000. Web The 30-year fixed-rate mortgage averaged 660 in the week ending March 16 down from 673 the week before according to data from Freddie Mac released Thursday. So the normal term of a reverse mortgage is the length of time a borrower remains living in his home after having taken out.

Web A reverse mortgage can be taken out by a homeowner aged 62 or older. Read more Not everyone is eligible for a reverse mortgage Along with age there are a few other requirements for taking out a reverse mortgage loan. A written document that shows an opinion of how much a property is worth.

While the amount is based on your equity youre still borrowing the money and paying the lender a fee and interest. If you apply and are approved for a reverse mortgage you have a three-day right of rescission after you sign the paperwork meaning you have three. Based in Colorado Cherry Creek is a.

Web A reverse mortgage works for our situation 3. GHLD a growth-oriented mortgage lending company originating and servicing residential loans since 1960 added an experienced reverse mortgage leadership team to expand its reverse mortgage division through its recent acquisition of Cherry Creek Mortgage. Web A reverse mortgage is a loan in the sense that it allows an eligible homeowner to borrow money but it doesnt work the same way as a home purchase loan.

Web Option 3. Web In This Article. Web To qualify for a reverse mortgage there are several requirements.

The 3 Types of Reverse Mortgages. Fizkes Getty Images. It describes what makes the.

If your working years are behind you youve got a lot of equity in your home and you need extra. Web A reverse mortgage is a type of loan reserved for seniors ages 62 and older which does not require monthly mortgage payments. These fees may include a credit report fee flood certification fee escrow fee document prep fee recording fee courier.

Web This is because 1 It relied on self-reporting and 2 Large banks could make money by strategically trading at the right time. With a reverse mortgage the amount the homeowner owes goes upnot downover time. We can be the reverse mortgage company that serves everyone.

Your debt keeps going up and your equity keeps going down because interest is added to your balance every month. Web A reverse mortgage is a type of loan that is used by homeowners at least 62 years old who have considerable equity in their homes. Take out a new mortgage.

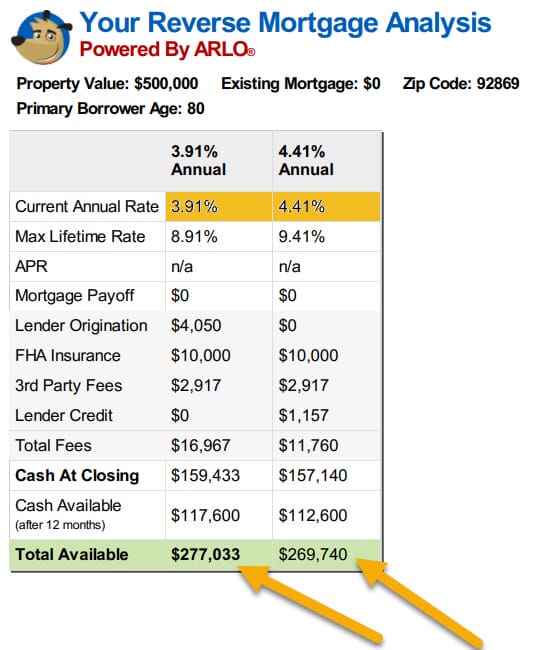

UNDERSTAND THE OBLIGATIONS Keep in mind that there are a number of associated fees that go along with a reverse mortgage. You must be 62 years of age or older. Heres how it works and how you can get one.

Web A reverse mortgage is a special type of home loan only for homeowners who are 62 and older. By borrowing against their equity seniors get access to cash. The reverse mortgage explained in simple and easy to understand terms.

Have either paid off a significant amount of your home loan typically 50 or own the property outright. Closing costs with a reverse mortgage are similar to costs associated with a traditional mortgage loan. Web A reverse mortgage is a loan that needs to be paid back one way or another.

In fact it was the source of the largest banking scandal in history at the time. 888-776-0942 from 8 AM - 10 PM ET. Web 54K views 2 years ago.

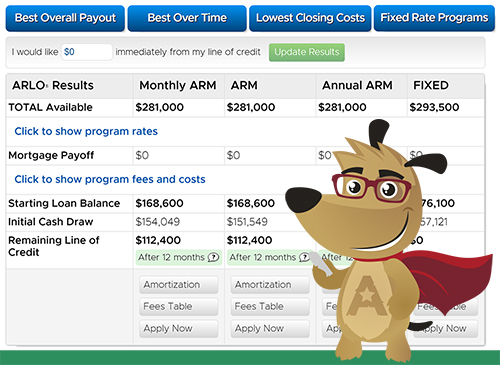

Some lenders waive or reduce the origination fees on certain products. Web Guild Mortgage NYSE. Web The costs of reverse mortgages and what happens at the end of the term of the reverse mortgage are two of the most significant factors you should focus on before signing on the dotted line.

Web MADISON Wis March 16 2023 PRNewswire -- Fairway Independent Mortgage Corp. Web Please change your search terms and try again. A growth-oriented mortgage lending company originating and servicing residential loans since 1960 added an experienced reverse mortgage leadership team to expand its reverse mortgage.

A HELOC or Home Equity Line of Credit is a bank product that is relatively inexpensive and quick to obtain. If you dont have the money to repay your loan balance and you pass away your reverse mortgage lender can force the. Reverse mortgages allow borrowers to use the equity in a fully or mostly paid-off residence to meet ordinary expenses.

Web A reverse mortgage increases your debt and can use up your equity. Web The reverse mortgage has greater flexibility than any other loan currently being offered such as equity loans or HELOCs. Appraisal fees can run from 300 to 600 independent legal advice from 300 to 700 and closing and administrative costs around 1795.

But in 2017 British officials announced their plan to. A year ago the 30-year fixed. We researched and reviewed the best reverse mortgages based on costs loan terms ease of procurement and more.

Continues its ongoing investment in its Reverse Lending Division by formalizing the new Regional Reverse SVP program. A lender can charge the greater of 2500 or 2 of the first 200000 of your homes value plus 1 of the amount over 200000. Frequently Asked Questions FAQs Photo.

Web A down payment of less than 20 usually means the borrower will have to pay for mortgage insurance. If the borrowers heirs want to keep the home they can simply take out a new mortgage on the house to pay off the balance of the reverse mortgage. A person usually the borrowers spouse or partner who also signs the reverse mortgage loan note and who.

Web Reverse mortgages key terms Appraisal. It also requires that borrowers pay FHA HUD mortgage insurance on the HECM program. Home Equity Conversion Mortgage.

A homeowner who is 62 or older and has. Fortunately this scandal had no apparent impact on reverse mortgage borrowers.

Reverse Mortgage Net

5 Rules That Apply To Reverse Mortgages In 2023

Glossary Of Terms Reverse Mortgage

White House Predicts Strong Reverse Mortgage Performance In 2023 Budget Makes New Legislative Recommendations Reverse Mortgage Daily

Reverse Mortgage Faq Frequently Asked Question On Reverse Mortgage

Here Are 3 Reverse Mortgage Examples In 2023

Broadview Home Loans Reverse Mortgage

What Is A Reverse Mortgage Z Reverse Mortgage Visual Ly

Fha Loan Limits For Greenwood Greenwood County Sc 2023 Verified Limit

2023 Fha Loan Limit In Pendleton Anderson County Sc

Glossary Of Mortgage Lending Terms Nw Reverse Mortgage

Mortgage Loan Officer Resume Samples Qwikresume

2023 Hecm Reverse Mortgage Loan Limits Mls Reverse Mortgage Powered By Zyng Mortgage

May 16 2009 The Colorado Tribune Pueblo

Is A Reverse Mortgage Right For You Trusted Choice

Reverse Mortgage For Purchase Access Reverse Mortgage

Reverse Mortgage Loan Glossary Key Terms You Must Know